TEMPO.CO, Jakarta - Indonesia's Financial Services Authority (OJK) is drafting new regulations to govern the activities of financial influencers, including criteria, scope, and content guidelines. The goal is to ensure that financial information shared with the public is accurate and trustworthy.

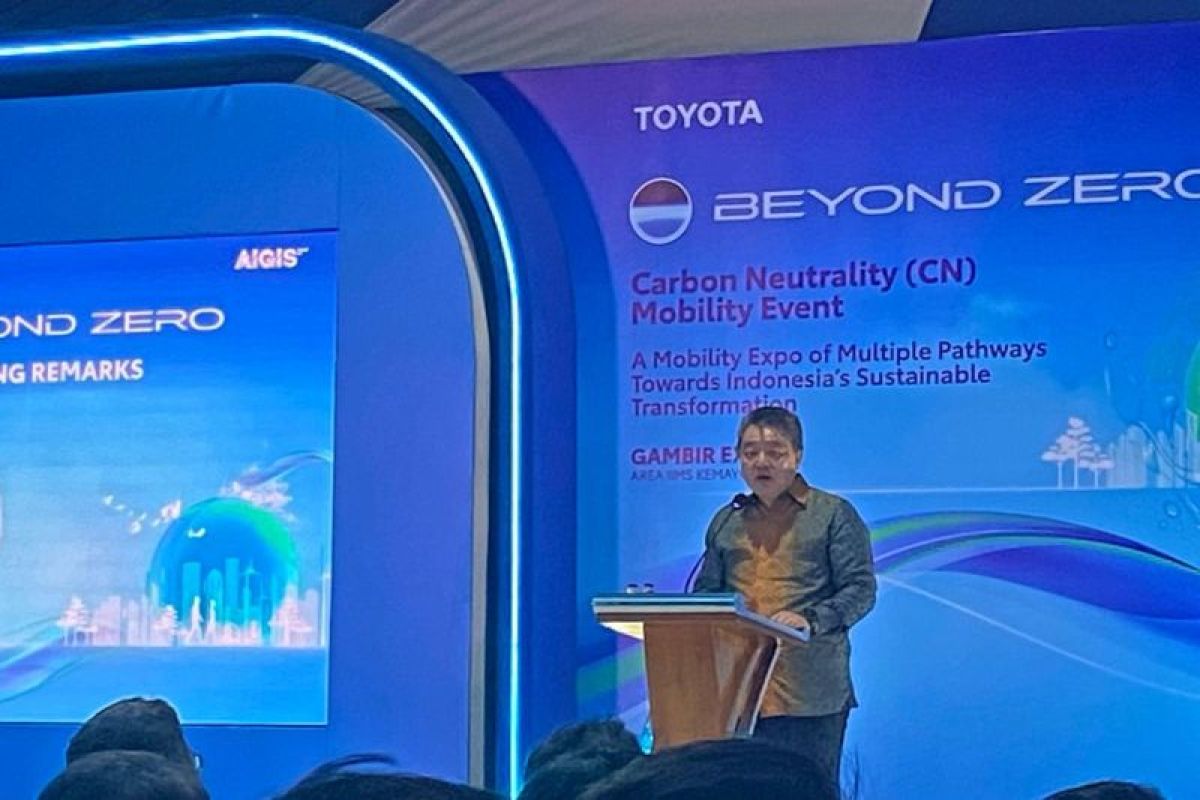

"We are currently reviewing the mechanisms for regulating and supervising the activities of financial influencers—whether they are providing educational content or promoting financial products on social media or other platforms," said Friderica Widyasari Dewi, OJK's Board of Commissioners member and Chief Executive for Financial Services Business Conduct Supervision, Financial Literacy, and Consumer Protection, during the agency's April 2025 monthly board meeting on Friday, May 9.

According to Friderica, the OJK's review covers a wide range of factors, including influencer qualifications, the type of activities they engage in, and how they communicate financial information. The aim is to ensure that financial education is conducted with transparency and accountability.

"For example, we are defining what kind of qualifications influencers should have, what transparency standards they must meet, and how they should present their information," she said.

She said that several existing OJK regulations already tightly govern financial products and services. Therefore, it is essential that communication channels, especially those used by influencers, are reliable and help improve public financial literacy.

"In addition, influencers must present their content ethically: it must be accurate, honest, clear, and not misleading. There should also be guidance or disciplinary measures in place if they violate the rules," she said.

Friderica added that the upcoming regulations would take into account existing rules, especially those related to marketing and information delivery. OJK is also consulting with financial influencers as part of the drafting process.

"We are gathering input from various stakeholders—from financial planner associations, professional certification bodies, the general public, and others."

She acknowledged that financial influencers play an important role in disseminating information to the public. That is why OJK aims to provide support and supervision to ensure the educational content they deliver meets established standards.

"People now tend to prefer getting their information from influencers. So, our approach is to bring them into the fold, to guide and support them, so that when they speak to the public, they meet the criteria we are putting in place," she concluded.

Editor's Choice: OJK Reports Sluggish Growth of Buy Now Pay Later Services

Click here to get the latest news updates from Tempo on Google News

OJK Reports Sluggish Growth of Buy Now Pay Later Services

2 hari lalu

OJK records a slowdown in public debt in the buy now pay later services in the banking and multi-finance sectors.

Indonesia's Komdigi Suspends Worldcoin App Offering Cash for Retina Scans

4 hari lalu

The World App, also known as Worldcoin, has been offering cash rewards ranging from Rp200,000 to Rp800,000 to individuals in exchange for retina scans

OJK Reports Decline in Crypto Transactions

17 hari lalu

The Financial Services Authority (OJK) has reported a decrease in cryptocurrency transactions, aligning with a global trend.

Indonesian Migrant Workers Send Home Rp253.3tn in Remittances in 2024

21 hari lalu

Remittances, or cross-border money transfers, from Indonesian migrant workers reached Rp253.3 trillion in 2024.

OJK Warns Indonesian Migrant Workers to Be Vigilant Against Fraud

22 hari lalu

The Financial Services Authority (OJK) warns Indonesian migrant workers to be cautious of fraud.

Post-Eid Spike in Paylater and Online Loan Defaults: What Risks Lie Ahead?

28 hari lalu

Many people now prefer to borrow money through online loan and paylater apps. Unfortunately, this convenience often leads to uncontrolled spending.

IHSG Closes at 6,262.2: Weekly Drop of 3.82%, Year-to-Date Decline of 11.67%

31 hari lalu

The Composite Stock Price Index (IHSG) closed this week at 6,262.2, down from 6,510.6 last week.

Celios Criticizes Insurance Plan for Free Meal Program: 'Commercializing Social Aid'

47 hari lalu

Center of Economic and Law Studies (Celios) criticizes the plan to implement insurance in the Free Nutritious Meal program (MBG).

OJK Responds to Calls for Trading Halt Regulation Review After IHSG Decline

54 hari lalu

The OJK has responded to a request from the Coordinating Minister for Economic Affairs, Airlangga Hartarto, to evaluate the regulation.

OJK Greenlights Share Buybacks Without Shareholders' Meeting Amid IHSG Slump

55 hari lalu

OJK has officially communicated this buyback policy to the boards of directors of publicly listed companies through an official letter dated March 18.